Advertorial

Sponsored Content Provided by Provide Savings

Why Did No One Tell Drivers About This New Rule?

(Daily Savings) - New policies proves drivers have likely overpaid on car insurance coverage for years. Can this be the end of overpriced insurance rates?

(Daily Savings) - New policies proves drivers have likely overpaid on car insurance coverage for years. Can this be the end of overpriced insurance rates?

This article sponsored by Provide-Savings

Disclosure:

Important information about the content of this article: Here are a few important clarification points regarding the content of this article. First, as stated at the top of this site, this is an Advertisment/Advertorial. This site receives compensation for purchases made through our links. The testimonial from Bill Johnson included in this article is real and truthful and was conducted internally to test the true effectiveness auto insurance comparison tools/websites. These results are not always typical and each users results may vary when using auto insurance comparison services mentioned in this article.

*Source: Click Here for an article on low mileage discounts. Low mileage discounts vary by provider, but usually fall between 7,500 and 15,000 miles per year. 15,000 divided by 365 equates to an average of 40 miles per day.

*Source: Click Here for the NAIC consumer auto guide which outlines that where you live (preferred zip code) and your prior insurance coverage (currently insured) has an affect on your rates.

*Source: Click Here for an article from J.D. Power which talks about how a clean driving record (No tickets, accidents and no DUI's) will qualify you for the lowest possible rates.

*Source: Click Here for a survey which analyzed car insurance quotes for 1,000 zip codes across the U.S. found that within a given zip code, rates vary by 154% on average, allowing drivers to find an average of 32% and $368 per year in savings.

*Source: Click Here for an article on "price optimization" and how loyal customers may pay higher rates.

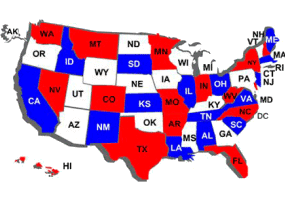

*Clarification of the advertising headline "New Rule in (Your State)". - Merriam-Webster's Dictionary defines the word "rule" as "a piece of advice about the best way to do something" (http://www.merriam-webster.com/dictionary/rule). This article aims to advise the public that comparing rates is one of the best ways that you can save money on car insurance. No matter what city, state or zip code you live in you can compare rates and get free quotes. If you truly want to find the best rate and save on car insurance then follow our advice or "rule" to compare rates. Here are links to two surveys which demonstrate the importance of comparing rates and how applying this "rule" in any state, city or zip code may help drivers save 32%. A new survey found that the #1 reason people switch is because they found a cheaper rate. Click Here for Survey. A second survey which analyzed car insurance quotes for 1,000 zip codes across the U.S. found that within a given zip code, rates vary by 154% on average, allowing drivers to find an average of 32% in savings. Click Here For Survey.

This site is committed to protecting the privacy of our online visitors.

All other online visitor data collected by this site is protected. We will not sell, trade, or give your personal information to other companies or organizations.

This site is in no way affiliated with any news source. As mentioned at the top of this web page, it is an advertisement.

This site contains affiliate and partner links, and as mentioned previously, this site is only an advertisement. The owners of this site receive compensation when sales are made.

Any testimonials on this page are real product reviews, but the images used to depict these consumers are used for dramatization purposes only.

This website and the company that owns it is not responsible for any typographical or photographic errors. If you do not agree to our terms and warnings, then leave this site immediately.